As Seen In...

Yes Kiana, I want The

PowerCourse NOW!

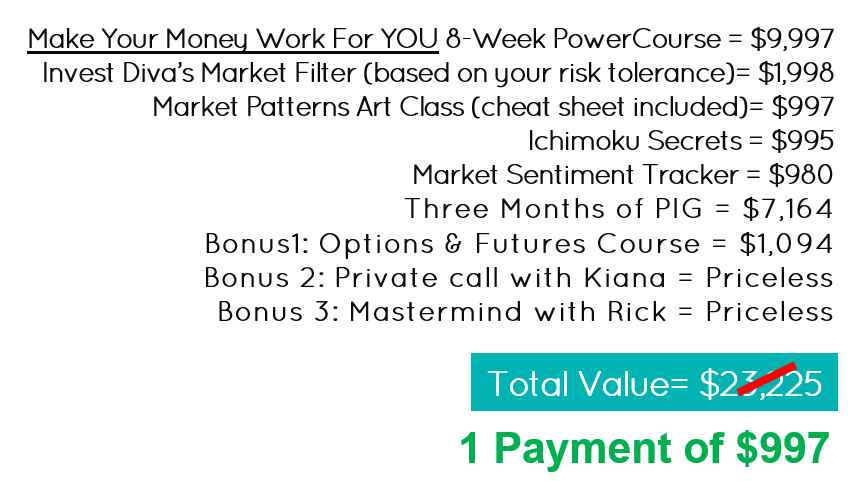

Item

Price

$3997

$597 Now and 7 Payments of $597 later

Billing Address

How would you like to get

Crypto Cash Machine Mastery?

CRYPTO CASH MACHINE MASTERY: Are you looking to expand your portfolio beyond just stocks and other traditional assets? Are you ready to become serious (not just curious) about cryptocurrencies such as Bitcoin and Ethereum and find out the SAFEST way to add them to your portfolio? If so, upgrade to get the Crypto Cash Machine Mastery for just an additional $247 and get full access and learn about the fundamentals of cryptocurrency, learn how to identify top-performing cryptos, and choose the right wallet and exchanges.

30-Day Action-Based Money Back Guarantee!

By clicking on the button below, you confirm that you have Read and Agreed to the Terms & Conditions. Please scroll down this page to review our 30-day Action-Based Refund Guarantee details and instructions.

Please do NOT apply for the PowerCourse if you are not willing to put in the work and apply our strategies. This is NOT a get-rich-quick scheme, nor it is a magic pill.

This is NOT for lazy people.

Pay by credit card:

Click the button above to pay with credit card

PayPal payment option:

(Note: when paying via Paypal, check the email linked to your Paypal account for course access instructions)

CUSTOM JAVASCRIPT / HTML

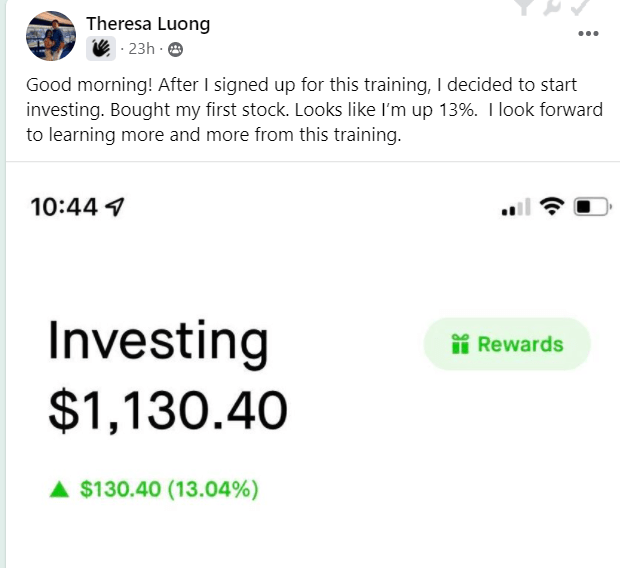

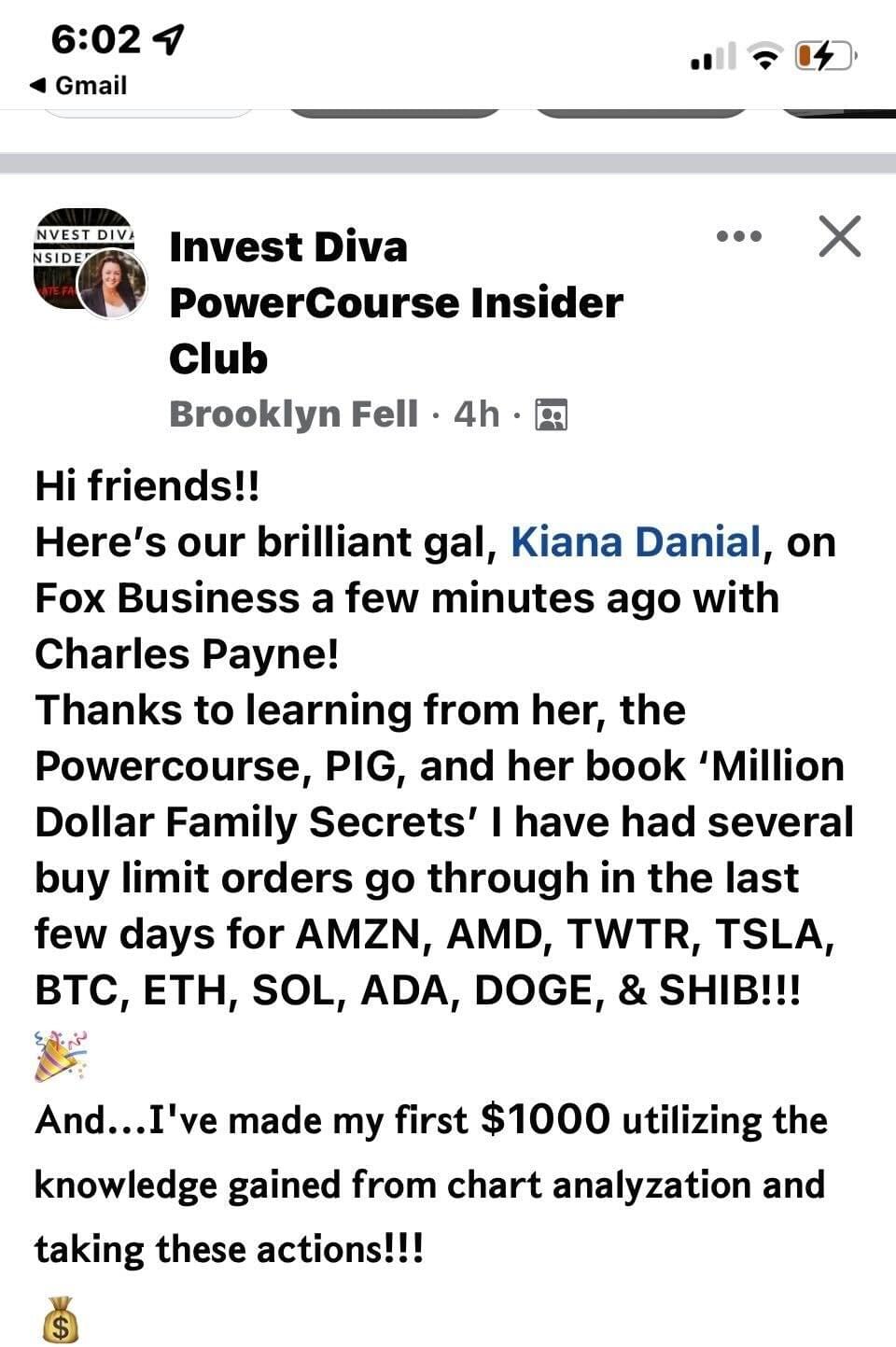

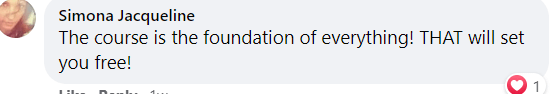

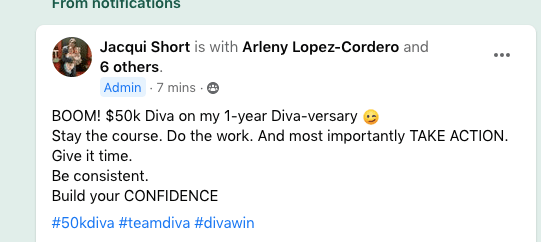

Student Success

Shabnam Shamloo - Built a $100K Portfolio

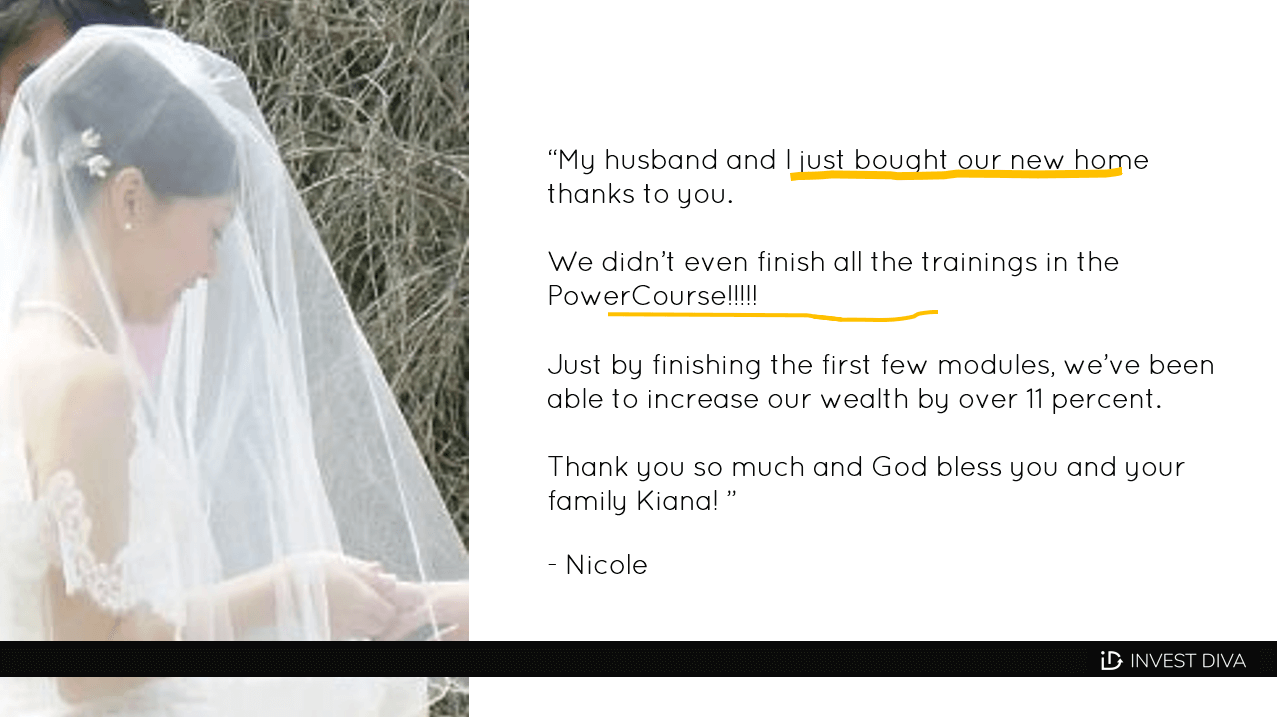

Nicole Das, Property Manager

Grace Wee,Healthcare Worker

"Within 1 year of signing up with Kiana Danial's Invest Diva Powercourse, my overall portfolio has grown by over 100%, with my best performing stocks based on Kiana's recommendations have grown by over 200%"

Mystie Arnold,

Entrepreneur, Mom of 2

"I am so grateful to have found Kiana! I had been "playing" around with the stock market way too long without the information or knowledge necessary to make sound, informed, responsible decisions.

Making the small investment in myself and in my family's financial future by taking her Make Your Money Work For You Power Course has been the BEST financial decision I have ever made.

Making the small investment in myself and in my family's financial future by taking her Make Your Money Work For You Power Course has been the BEST financial decision I have ever made.

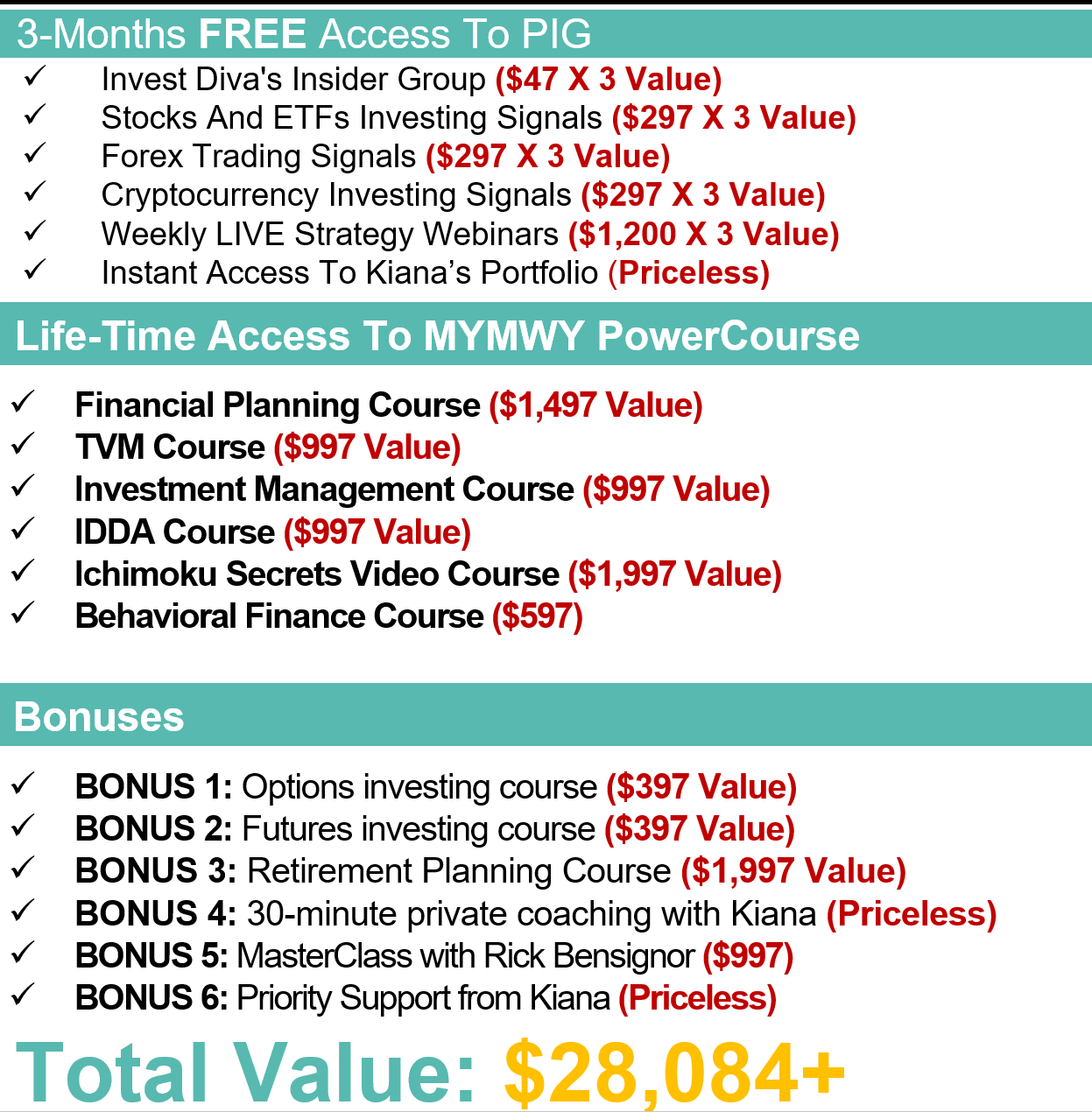

WHAT YOU'LL GET

WHAT YOU'LL GET

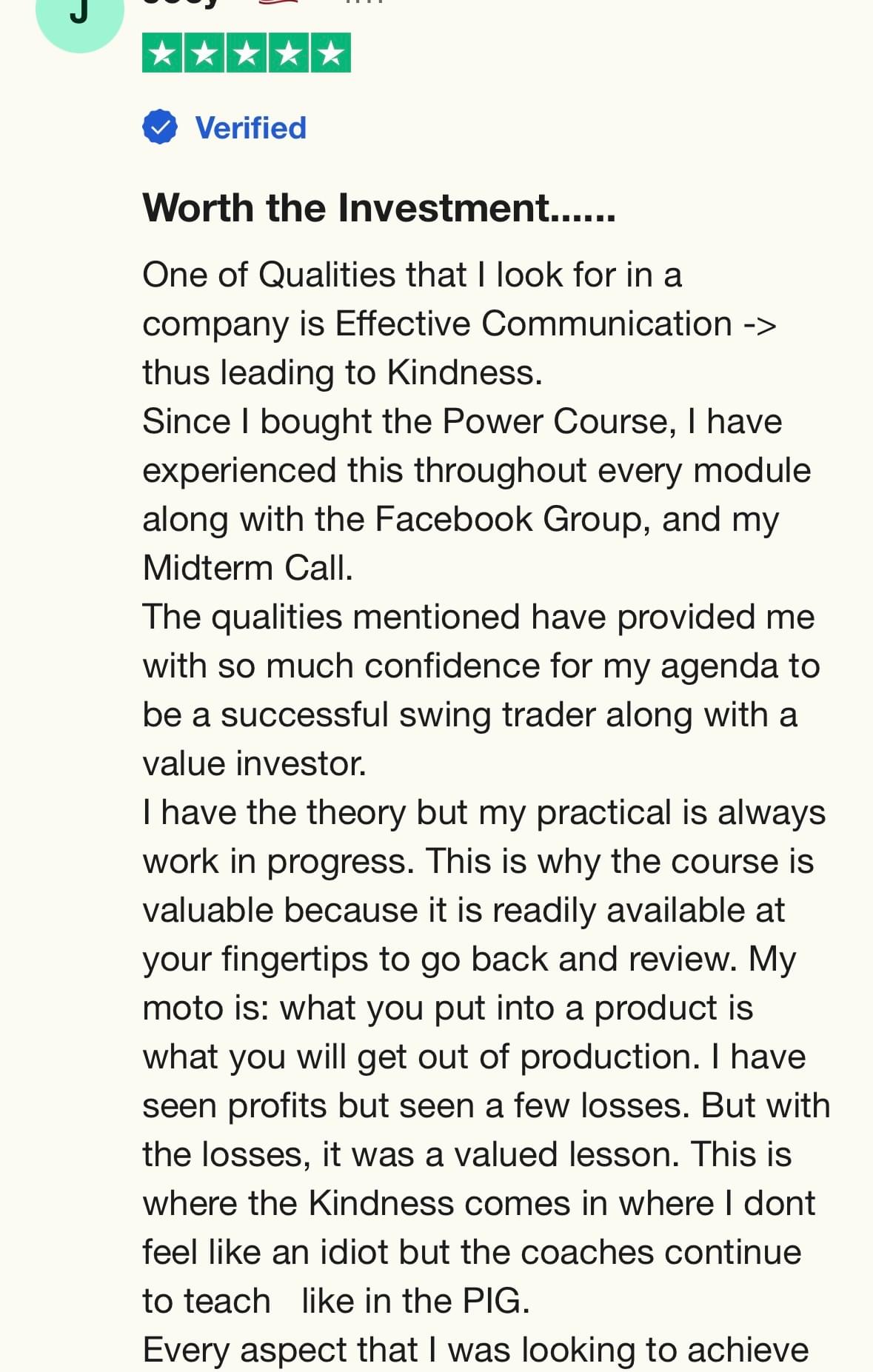

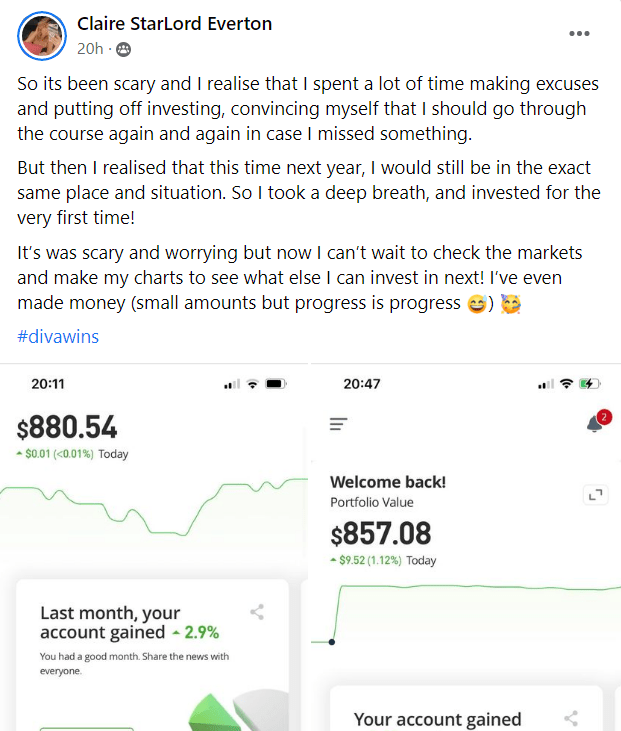

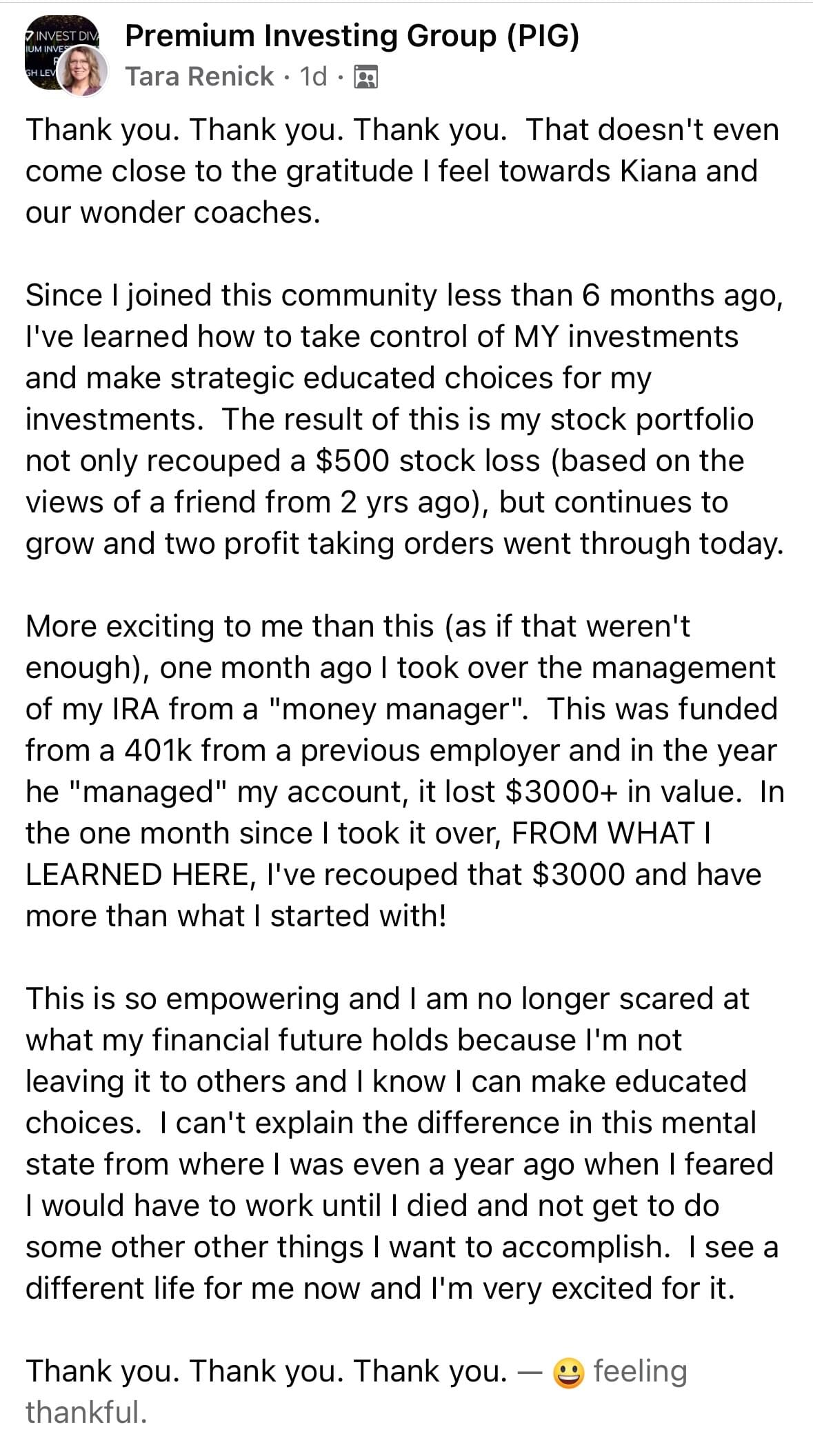

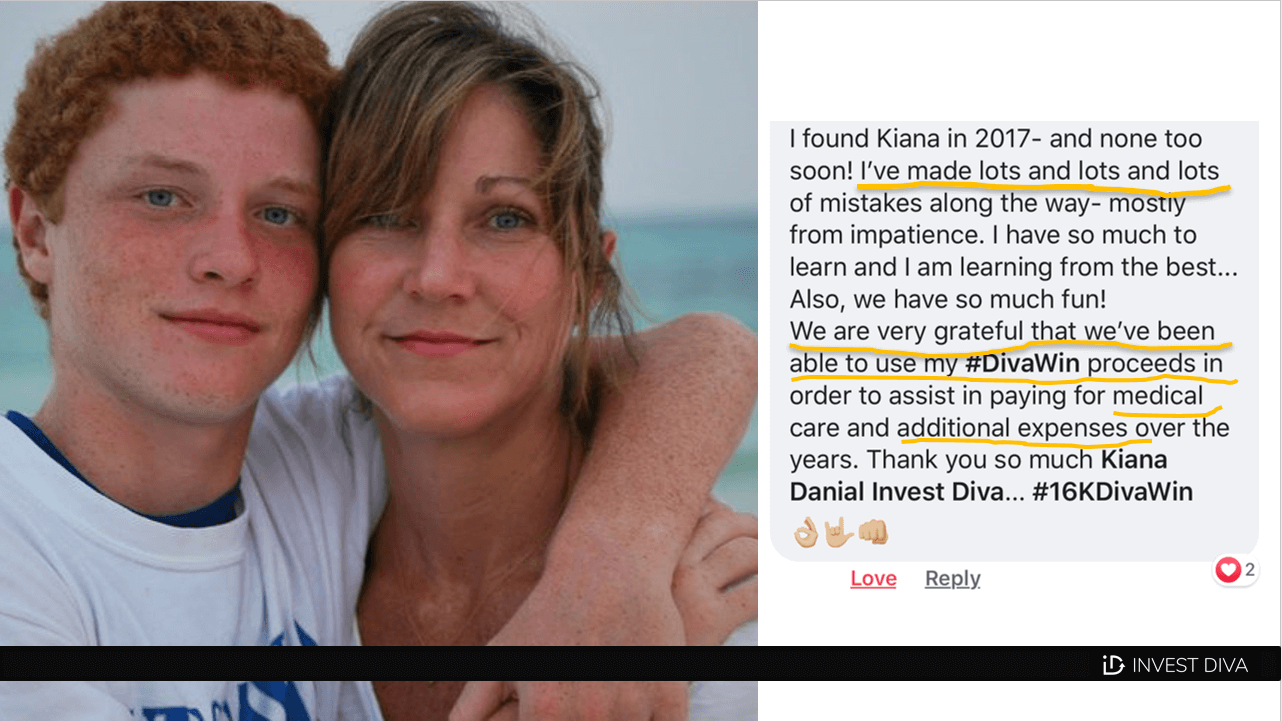

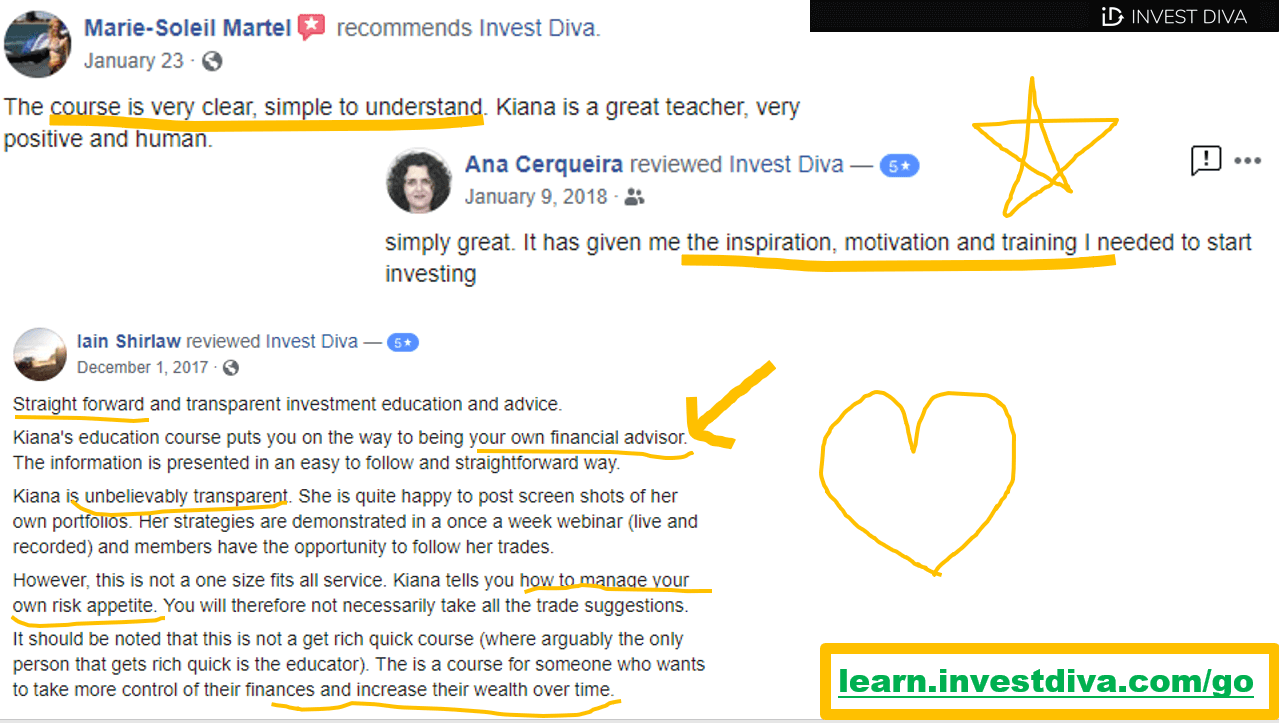

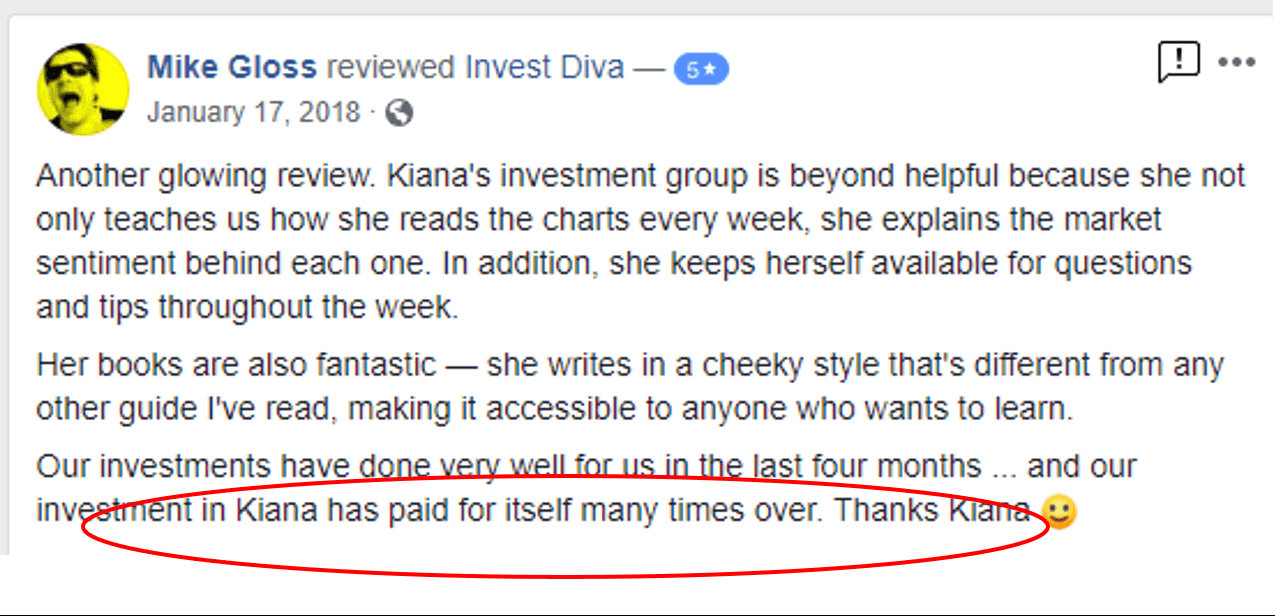

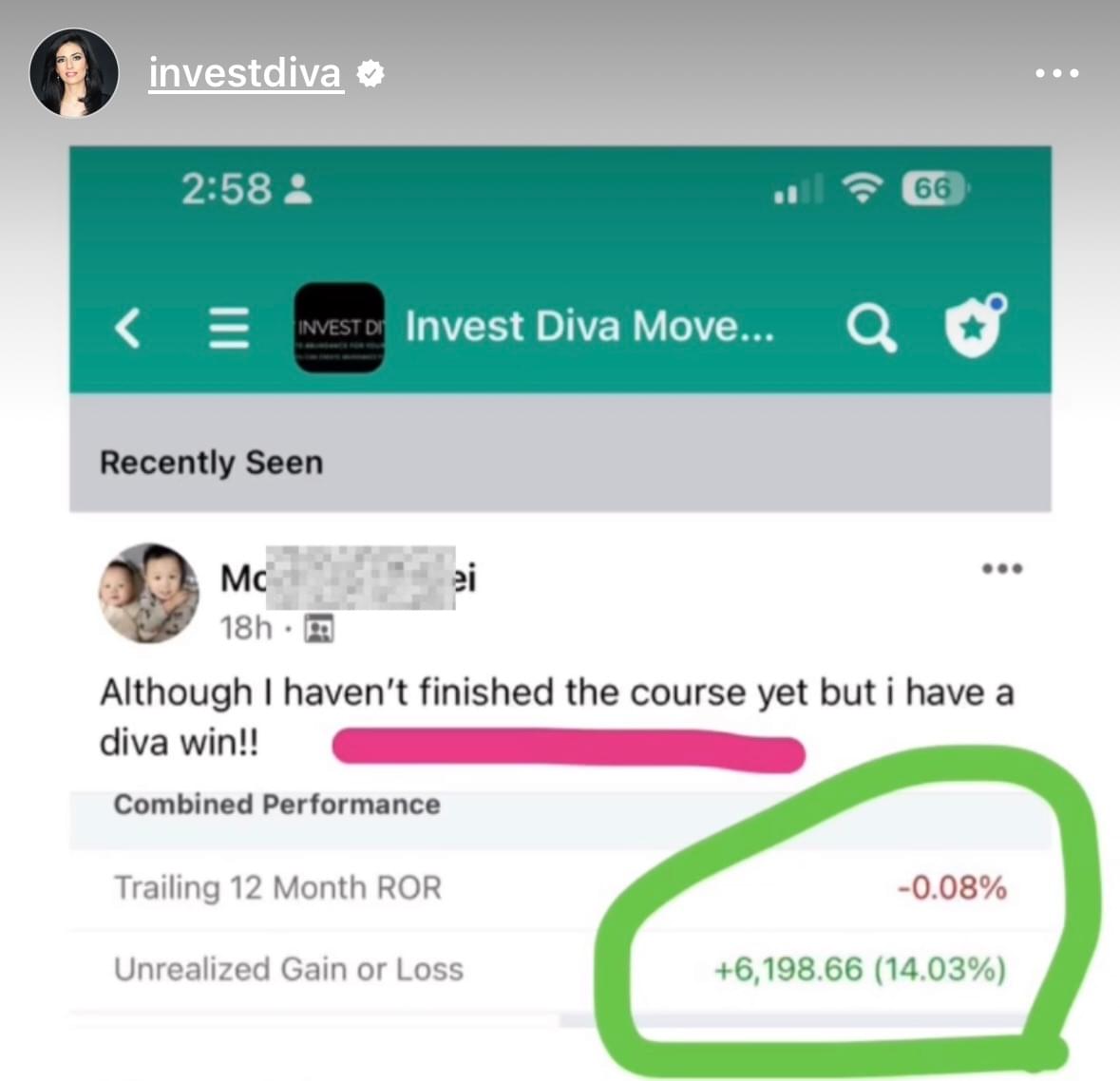

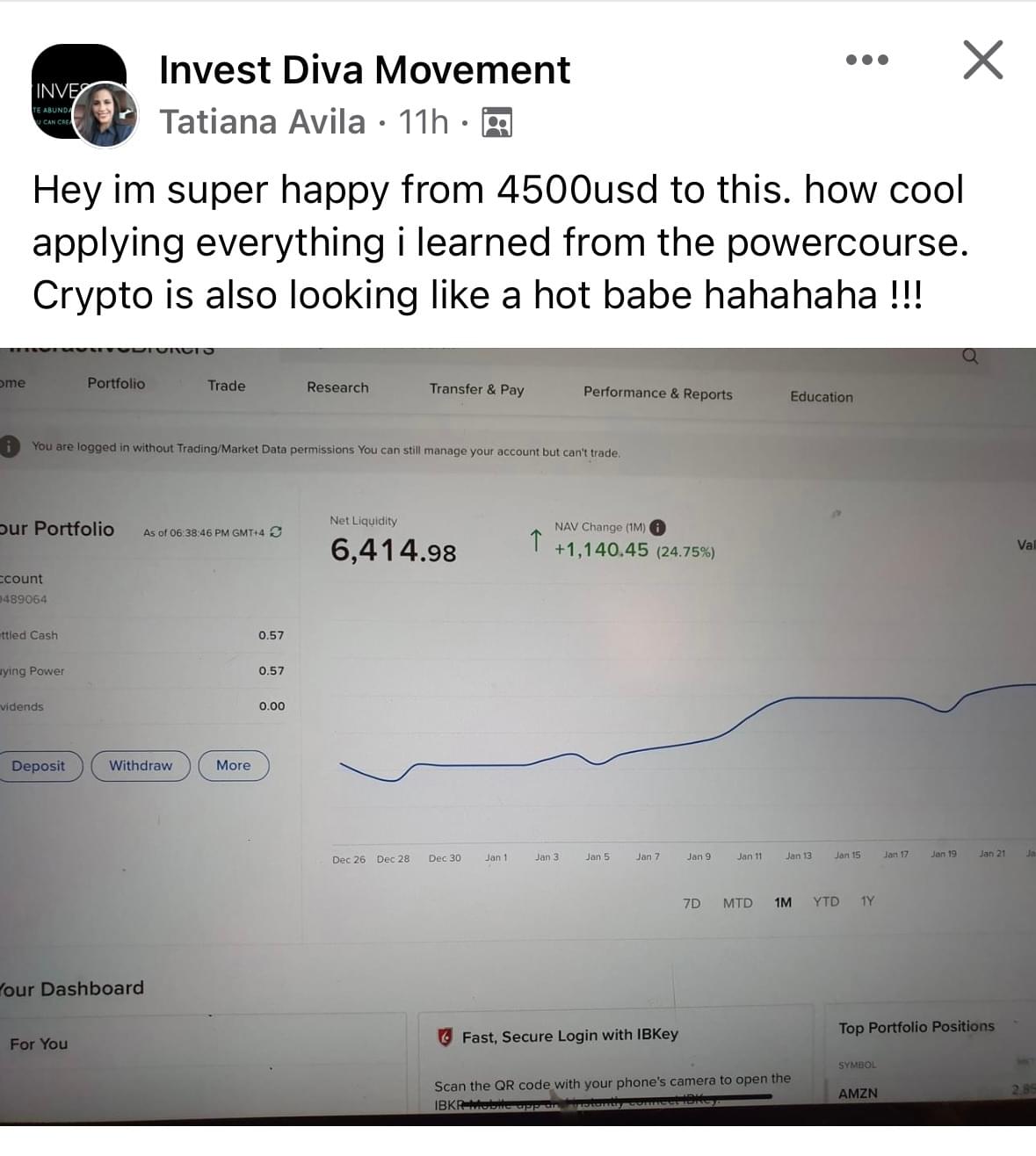

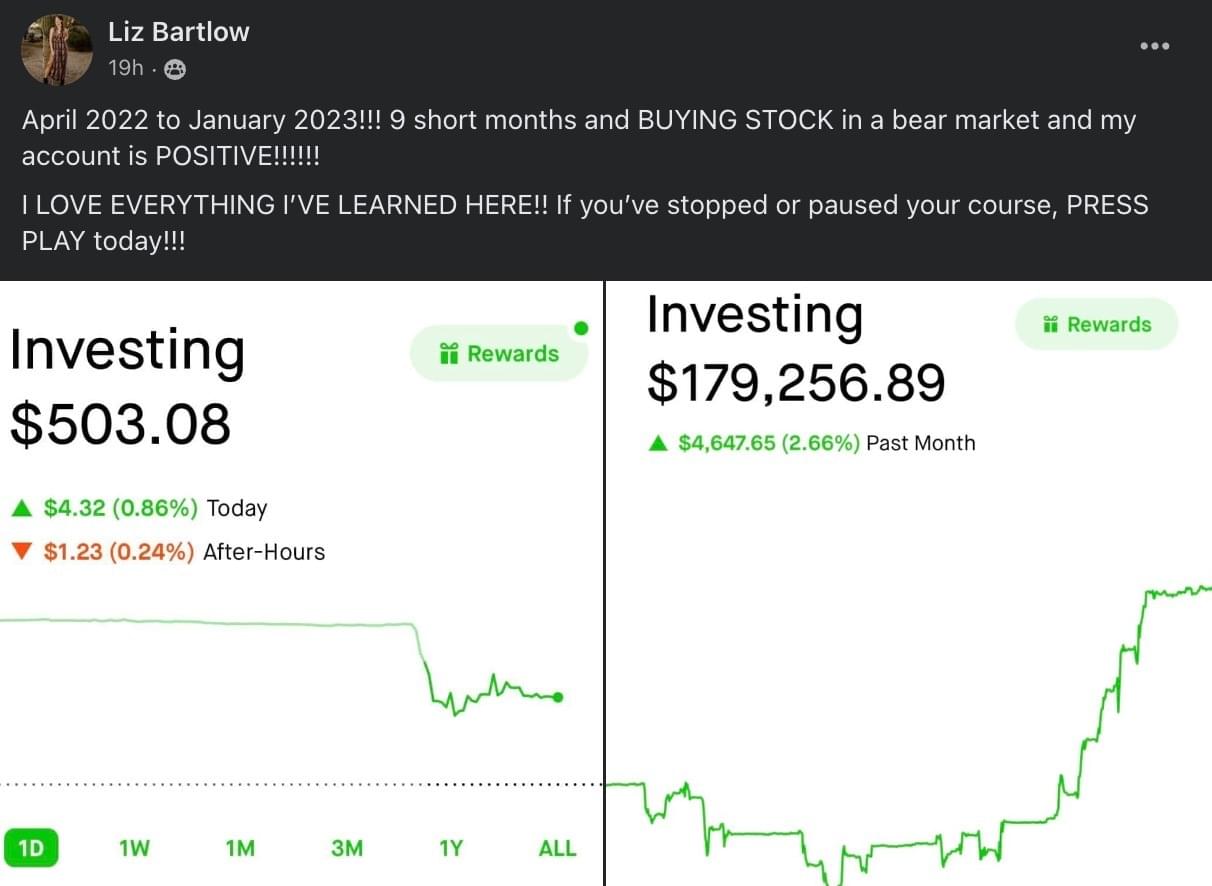

Student Testimonials

You'll start with...

You'll start with...

- Lifetime Access

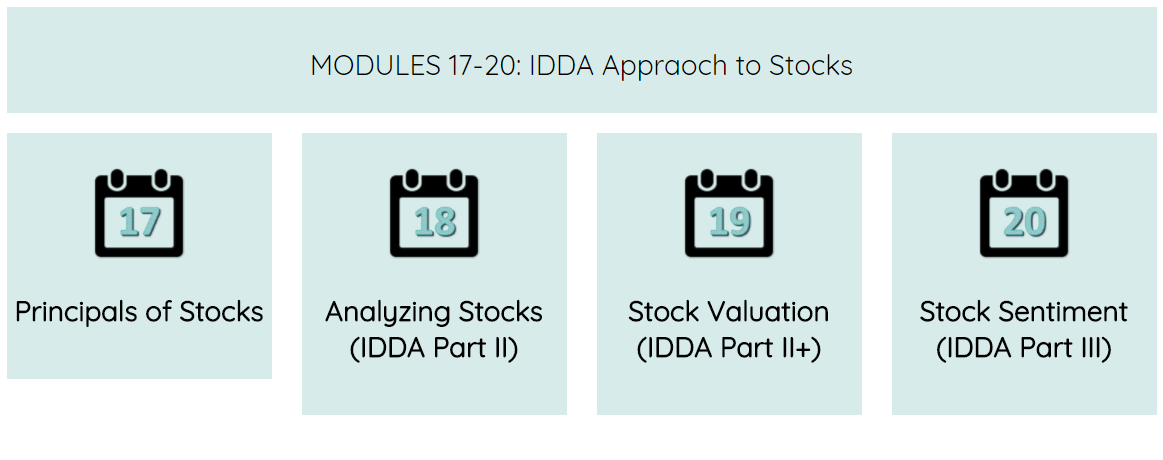

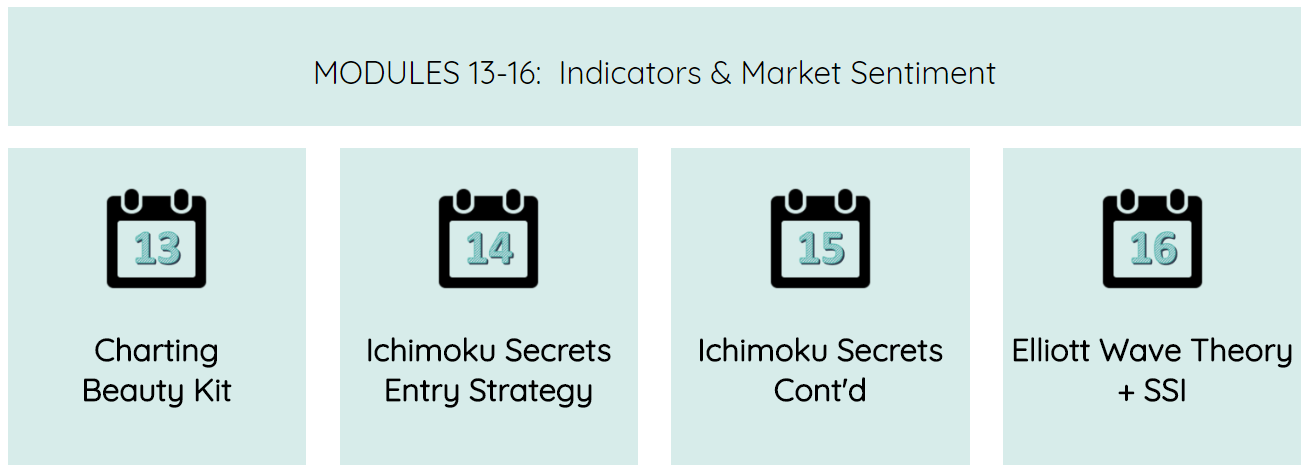

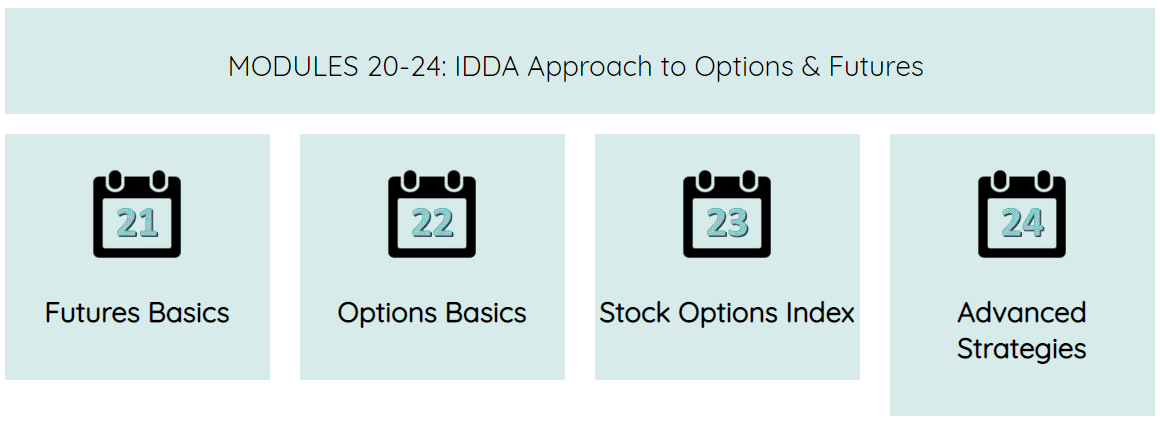

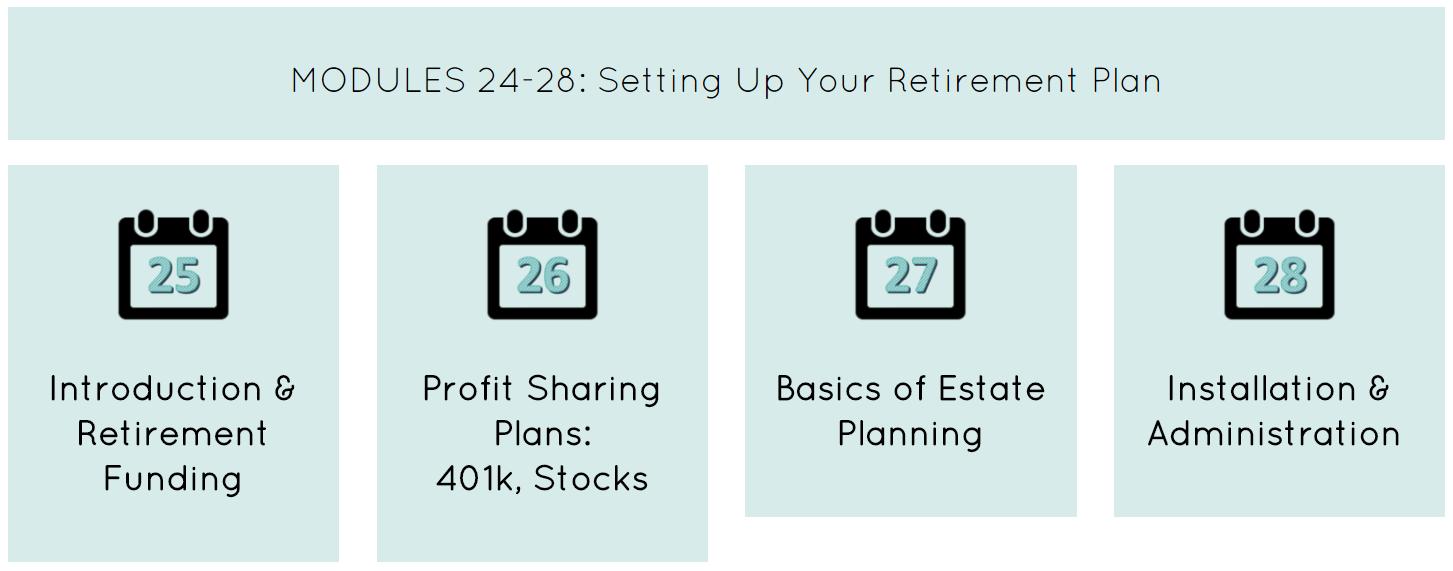

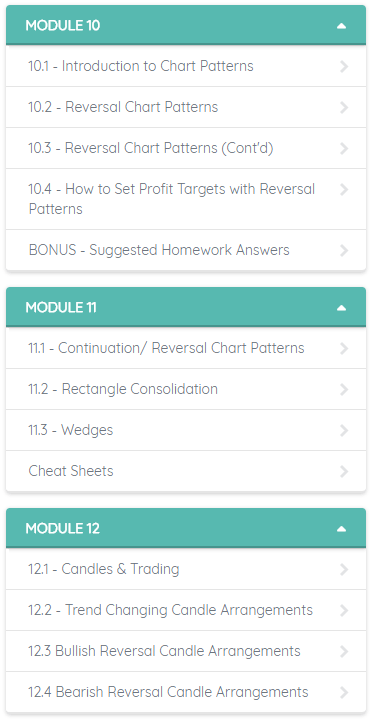

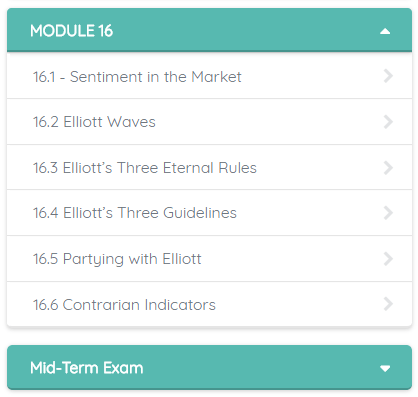

- To the Make your Money Work For You PowerCourse that includes an eight-week step-by-step guide, tons of videos, cheat sheets, templates and more so that you can get off the ground on the right foot, fast. (Value: $20,000.00)

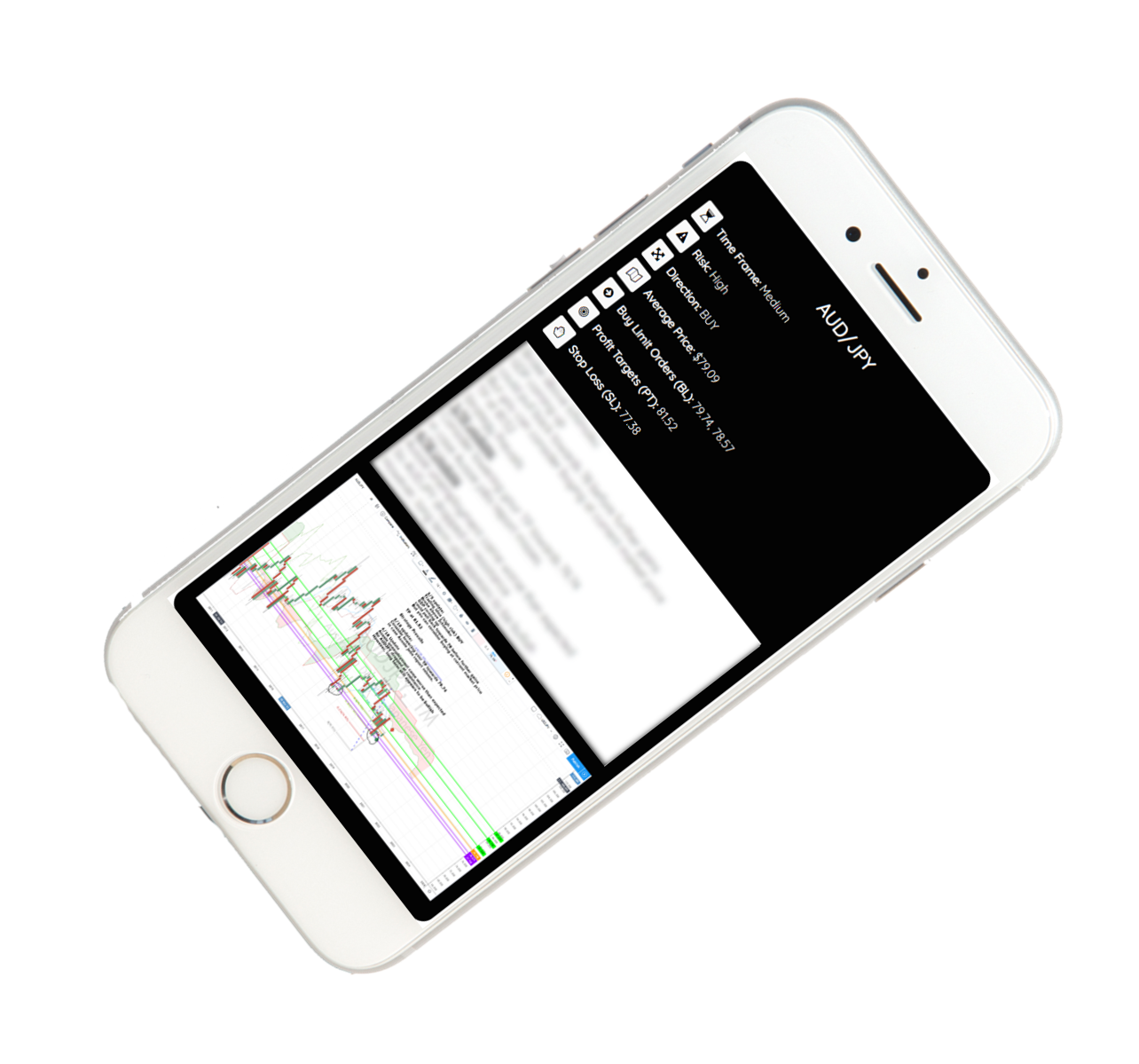

- 30 Days FREE Membership: Premium Investing Group

- Cut down on market noise by adopting our tailored investment strategies, designed to align with your risk tolerance and financial goals. Avoid the mistakes I made as a beginner, like blowing up my account! Receive a concise and engaging monthly newsletter at your doorstep, summarizing all our investment insights. This eliminates the need for time-consuming research on which stocks to buy, when to buy, and when to sell. Each month, I'll share my essential MUST-HAVE list, spotlighting the assets in my $5M portfolio, and I'll highlight my TOP portfolio pick. Dive into 30 days of access to the Premium Investing membership area. Here, you can fine-tune investment strategies based on your financial aspirations and participate in real-time weekly live sessions with our Premium coaches. They'll guide you in crafting your strategies, enabling you to become your own savvy money manager. And as a special perk for Powercourse members, after your 30-day free trial, you can continue with Premium Investor status at a whopping 90% discount. (Value: $6,756)

- Three Private Calls With Platinum Coaches

- When you invest today, you'll get 30 days of free access to our Platinum Coaches. These coaches are part of a service that usually costs $25K a year. Right now, our Platinum members are paying $2,083 every month for this. These coaches will help you find the best way to succeed in this program. After you invest, you'll get a link to book your first of three private calls with your Platinum coach. They'll help you start off the right way to get the most your of your membership without getting overwhelmed and answer any questions that you may have. Once the 30 days end, you can choose to stop, move up to Platinum coaching, or keep going with the Premium Investing Group at a special rate just for Powercourse members. And think about it: just one tip from our Platinum coaches might pay off your whole investment in less than a month. (Value: Priceless)

- Volatility Proofing Hacks:

- So you can instantly create an investment portfolio that can weather through any type of market, when one type of asset like the stock market is down, you find other investing opportunities to hedge and balance your portfolio, and continue to make money, EVEN during an economic recession. (Value: $5,997)

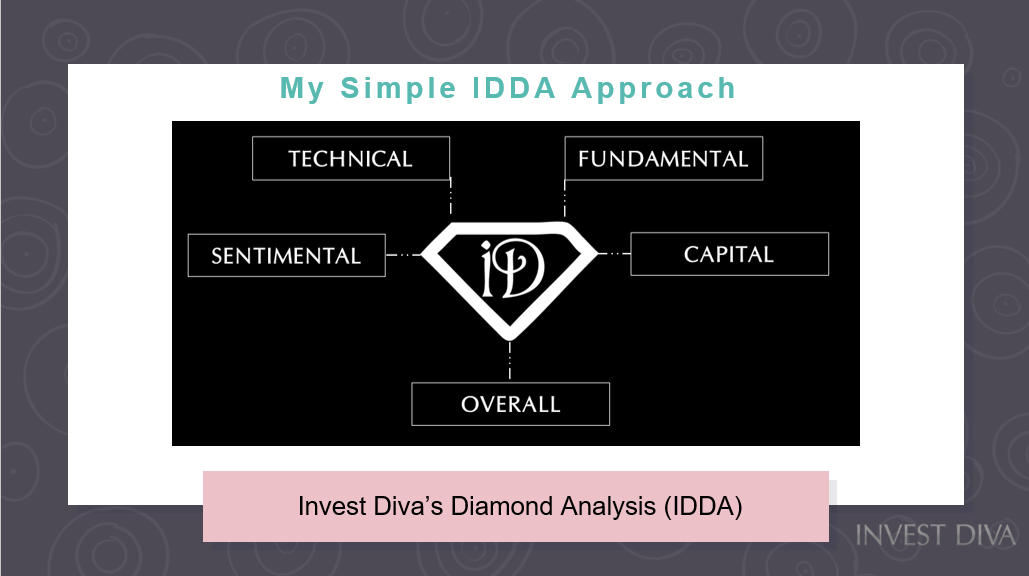

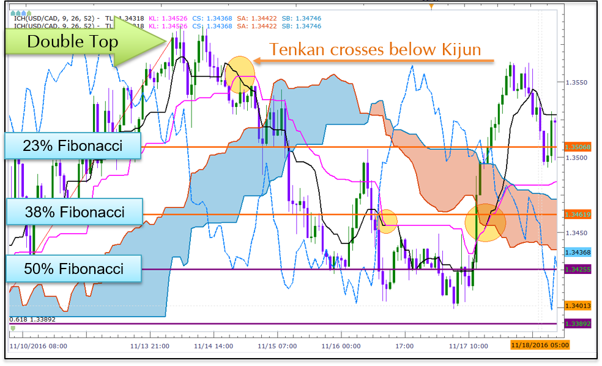

- My Weird Japanese Investing System

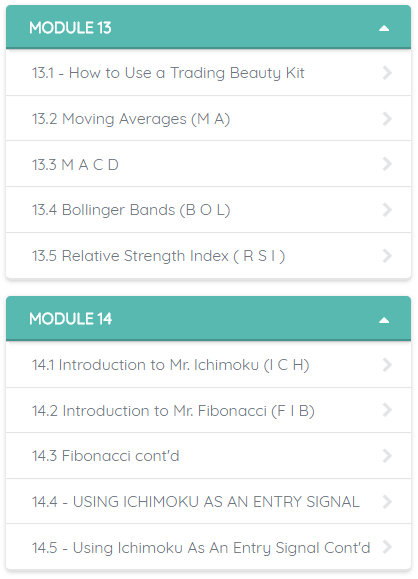

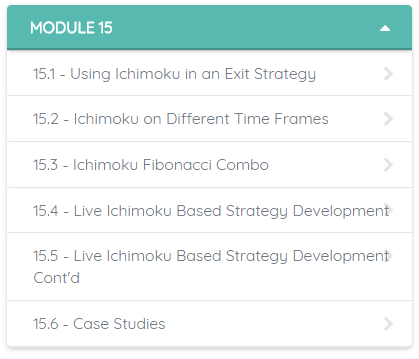

- My step-by-step guideline to Ichimoku, Fibonacci and the IDDA investment system that makes me over 325% return per year (Priceless)

In a couple weeks, once your dreams are starting to turn into plans, we'll crack open the vault and dig deeper into the details of success with my...

- The Ultimate Investor’s Toolkit

- Every tool you need to make investments that are perfect for you, and only for you including my Profitability Calculator , Risk Assessment Calculator, Investment indicators , Technical Analysis secrets, all of my favorite investing sites & resources, and much much more... ($997 Value)

- Secret TAX Loopholes [NEW!]

- The biggest problem for our students who are rocking it and 10X and 100xing their money, is avoiding to pay a TON of taxes on their capital gains they make using the Invest Diva strategies. So I got my personal accountant to show you some tax reduction strategies. (Priceless)

- My Black Book of Investments

- For those of you who are like me and need to see actual examples of how things are done in real life, you’re also gonna get my black book of investments with real life examples of my low, medium, and high risk investments all with video walk throughs to make is faster and easier for you to recognize a the right investment for you when you see one, and red flags when they pop up. ($497)

-

Mastermind with Rick Bensignor

- Wall Street veteran and hedge fund consultant shares his trading secrets. ($597)

-

Private Calls with Platinum Coaches

- Up to 3 personal 1 on 1 calls with one of our Platinum coaches for 1 month at ZERO additional costs…(priceless)

Total Value: $34,844.00++ USD

Limited time offer: ONLY $3,997 USD

Student Success

Tonya Rideout - Built a $500K Portfolio

Edyta Awan, single mom - Built a $200K Portfolio

Ken Yards - Built a $100K Portfolio

Invest Diva Movement

The Place To Take Control Of Your Financial Future & Make Your Money Work For You

Disclaimer: Any information presented is not investment advice.

Please carefully read the Term of Services and Privacy Policy

EARNINGS DISCLAIMER: The Invest Diva Movement and the Make your Money Work For You PowerCourse were created to help those who want to grow their wealth through investing in online financial assets such as stocks . While many have achieved financial success by following the steps outlined in the course, this is not a get-rich-quick program. If you want to find a get-rich-quick scheme, we encourage you to scroll right by us, and we wish you well in your endeavors. Seriously, the internet is full of them...you just won’t find one here. The products and services offered to Make Your Money Work For You PowerCourse members are exclusively for informational and educational purposes. This program requires hard work, dedication, a focus on learning…and we’ve found that a heart for helping others is pretty dang helpful in both life and business.

PowerCourse Refund Policy

We want you to be satisfied with your purchase but we also want you to give your best effort to apply all of the strategies in the course. We offer a 30-day refund period for purchases if less than 35% of total course material has been viewed (we use a database provider who provides accurate metrics regarding viewership of total course content). However, in order to qualify for a refund, you must submit proof that you did the work in the course and it did not work for you. Please note, if you select the monthly payment option we are not able to stop payments without a refund request being submitted.

This is what we call satisfaction guaranteed. What that means is that once you get in, participate in the program and submit your answers to the review questions for the first 6 modules out of the 28-module PowerCourse and still don’t think it’s right for you, we’ll gladly give you a full refund…

You must complete the refund requirements (see below for instructions) within 30 days of enrollment. Refunds are given only when requested by email, by a student who has purchased the Powercourse and has completed the review questions for the first 6 modules. The answers must show that you indeed have made progress and understand the basics of each module.

Please only join the Make Your Money Work For You PowerCourse if you are an action taker and you know you are going to put in the effort and actually do the work and study as this is not one of those get-rich-quick programs.

Now here is some legal stuff (you had to know that was coming.) Nothing on this page, any of our associated websites, social media properties, or any of our content or curriculum is a promise or guarantee of future earnings or results. We always recommend using caution and consulting your accountant, lawyer, or professional financial advisor before making any investment decision or before acting on this or any other business or financial information. Basically: talk to professionals before you start investing, recognize that all investments come with an inherent risk, and we don’t guarantee results. Pretty straightforward, right?

Now here is some legal stuff (you had to know that was coming.) Nothing on this page, any of our associated websites, social media properties, or any of our content or curriculum is a promise or guarantee of future earnings or results. We always recommend using caution and consulting your accountant, lawyer, or professional financial advisor before making any investment decision or before acting on this or any other business or financial information. Basically: talk to professionals before you start investing, recognize that all investments come with an inherent risk, and we don’t guarantee results. Pretty straightforward, right?

Instructions to qualify for a Powercourse Refund

**Please Do NOT Purchase If You Are Not Ready To Commit To Taking Control Of Your Financial Future**

**Please Do NOT Purchase If You Are Not Ready To Commit To Taking Control Of Your Financial Future**

- Requirement 1: It’s been less than 30 days since you purchased

- Requirement 2: You completed less than 35% of the course material

- Requirement 3: You viewed 100% of the videos for modules 1-6

-

Requirement 4: Complete the Review Questions and Homework Assignments in Modules 1, 2, 3, 4, 5, and 6, and submit results from research and answers to Invest Diva via email to support@investdiva.com

-

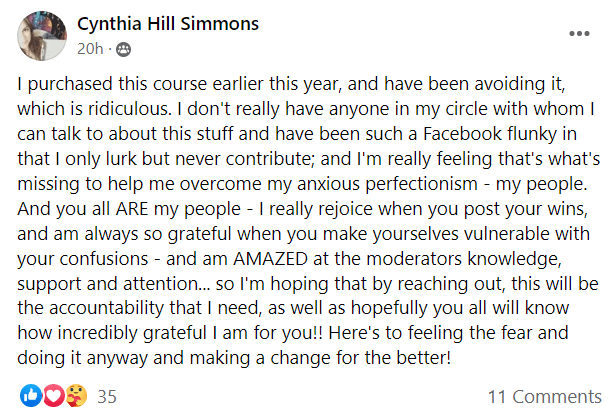

Requirement 5: Must participate in the private Insider Club Facebook group: Write one post per week, or one comment on another member’s post, or ask one question you may have or advice from members for 2 weeks.

Here are the modules homework assignments you are required to complete:

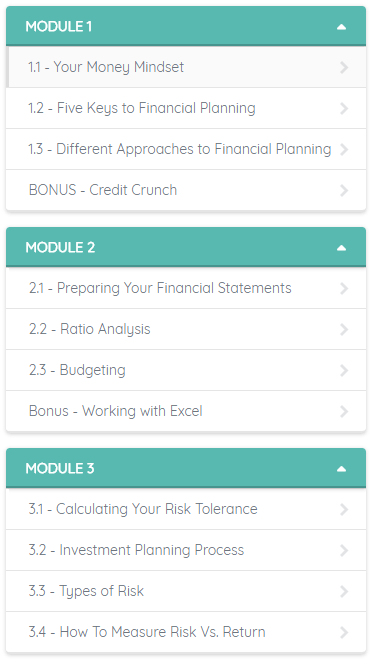

- Module 1:Mindest & Financial Planning

- 1.1 (3 Homework Assignments)

- 1.2 (1 Homework Assignment)

- 1.3 (2 Homework Assignments)

- Module 2 :Current Financial Situation

- 2.1 (3 Homework Assignments)

- 2.2 (3 Homework Assignments)

- 2.3 (1 Homework Assignment)

- Module 3: Your Risk Tolerance

- 3.1 (1 Homework Assignment)

- 3.2 (1 Homework Assignment)

- 3.4 (2 Homework Assignments)

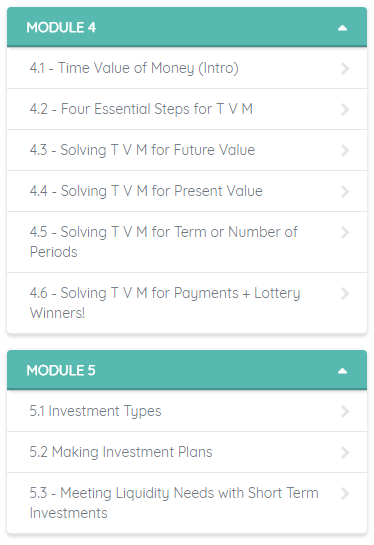

- Module 4: Time Value of Money

- 4.3 (2 Homework Assignments)

- 4.4 (2 Homework Assignments)

- 4.5 (1 Homework Assignment)

-

4.6 (2 Homework Assignments)

- Module 5: Starting to Invest

- 5.3 (1 Homework Assignment)

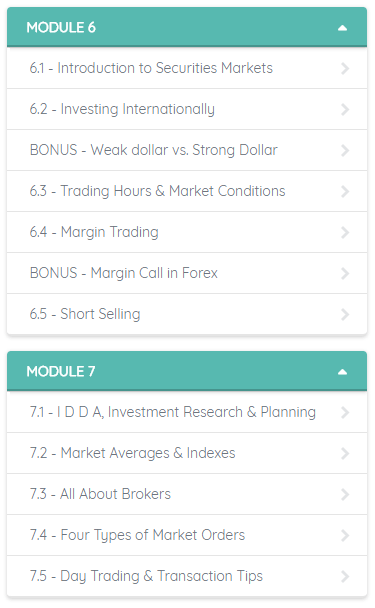

- Module 6: Stocks | Margins | Short-selling

- 6.1 (1 Homework Assignment)

- 6.2 (1 Homework Assignment)

- 6.3 (1 Homework Assignment)

- 6.4 (1 Homework Assignment)

-

6.5 (1 Homework Assignment)

*Note: you are NOT required to use personal information to complete the homework! You can use example data when completing.*

*ONLY after completing all of these steps, if you feel the course still hasn’t helped you to take control of their financial future, will we offer a refund.*

*ONLY after completing all of these steps, if you feel the course still hasn’t helped you to take control of their financial future, will we offer a refund.*